How to Get Seed Funding for Your African Startup in 2026

Great ideas don’t automatically attract investors. Most African founders struggle, not because their products aren’t valuable, but because they don’t appear “investment-ready.” Funding success comes down to how clearly you present your story, traction, financials, and strategy.

Here’s how to position your startup to raise seed capital in 2026 :

1. Investors Want More Than a Good Idea

Before writing a cheque, investors look for clear execution and scalability. They expect well-prepared materials, proof of momentum, and a strong understanding of your numbers.

2. A Clear, Professional Pitch Deck

Your pitch deck is your first impression. It must communicate your problem, solution, market size, business model, traction, team, and funding ask in a clean and compelling way.

3. Financial Projections That Make Sense

Investors will challenge your numbers. You need realistic revenue forecasts, CAC/LTV, unit economics, and a solid grasp of your cash flow and runway.

4. Real Market Research

Avoid vague claims. You need clear customer segments, data-backed market size, competitive analysis, and a practical go-to-market plan.

5. A Credible Online Presence

Your website, social media, and brand messaging should look intentional and professional. Investors check these things before booking a meeting.

6. Documented Traction

Show evidence of growth user numbers, revenue, waitlists, testimonials, or partnerships. Present your traction with clean charts and visuals.

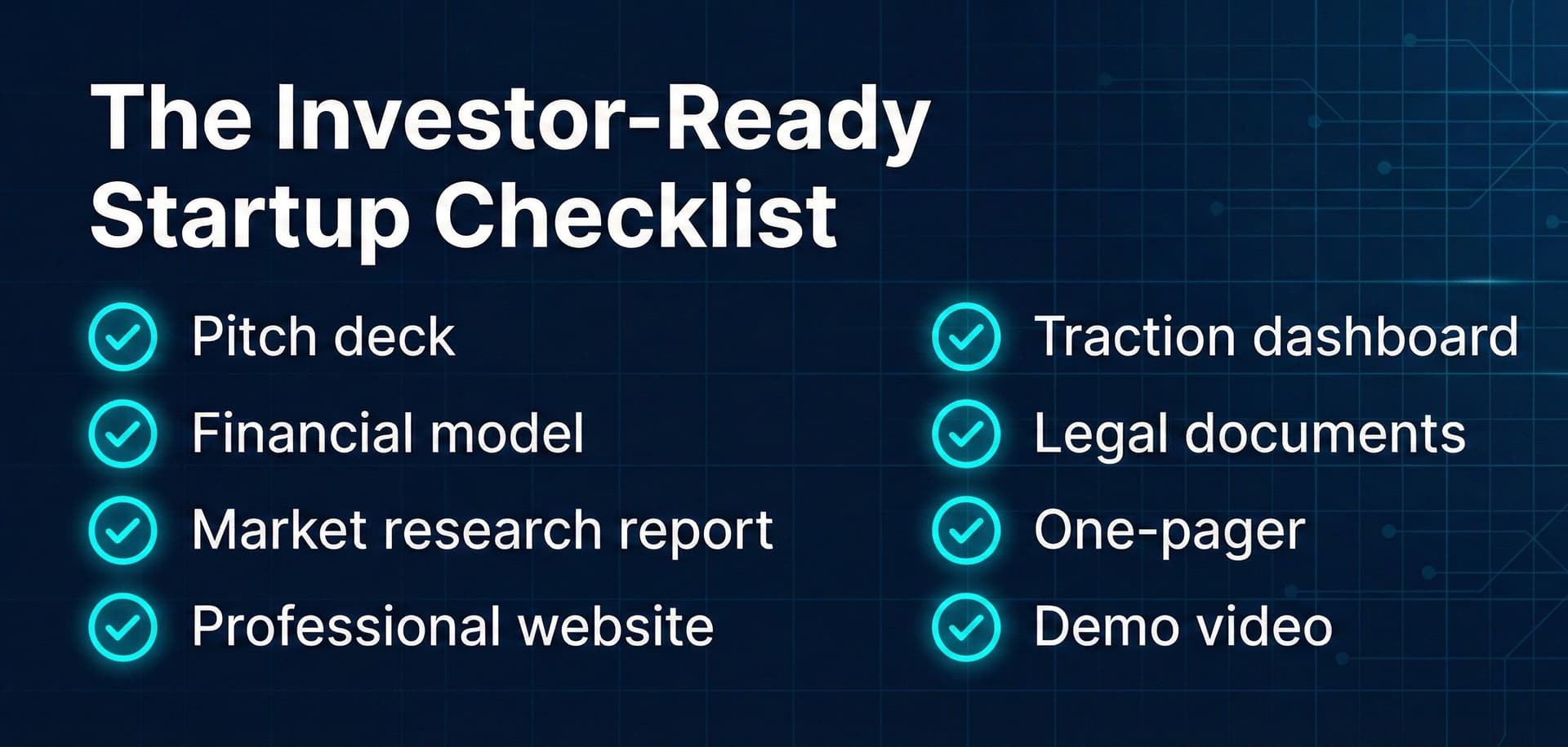

7. Build a Strong Investor Package

To look investment-ready, prepare four key materials:

Pitch deck

Financial model

Market research

One-page executive summary

All four should tell one consistent story.

Here is a 6-Month Path to Raising Seed Funding

Month 1: Prepare

Audit your materials, organize your numbers, identify gaps.

Month 2: Build

Develop your deck, financial model, market insights, and traction visuals.

Month 3: Outreach

Find aligned investors, secure warm introductions, and start sending your materials.

Months 4–6: Raise

Pitch confidently, respond to due diligence quickly, negotiate terms, and close your round.

Raising seed funding in Africa is absolutely possible but investors back preparation, clarity, and execution, not just good ideas. If you can communicate your traction, numbers, and strategy with confidence, you’ll stand out and attract the right investors.

The more investment-ready you look, the faster opportunities open up.